Hong Kong air ticket price war? SIA joins in the fray with $368 offer, but hours later...

a) Distinguish between fixed and variable cost and discuss why costs might be lower for the budget airline compared to the full service airline. [10]

In the short run, when a firm is doing business, it will encounter costs. These costs can be divided into two categories: fixed and variable costs. Fixed costs are defined to be factor input costs incurred in the short run (SR) which even at zero output, will be incurred by the firm. Variable costs, on the other hand, are defined as costs of factor inputs which can be altered in the SR.

Hence, in the SR, fixed costs are constant regardless of output while variable costs change depending on the amount produced.

Total cost in the SR is given by fixed cost plus variable costs.

The advent of budget carriers in Europe and the US, and now Asia, has been mainly due to the lower costs incurred by budget carriers, thus they are able to offer lower prices to attract the more price conscious consumer. There are various reasons for this lower cost.

Many fixed and variable costs have become lower. Budget airlines may land at smaller airports which charge less landing fees. Budget carriers also do not provide many services such as in-flight meals, movies, blankets, peanuts, etc., thus reducing fixed costs (some of these may be considered variable too). Their airplanes do not always dock at the gates either and this reduces airport fees as well. Free seating also means there is less administration costs during issuing of tickets.

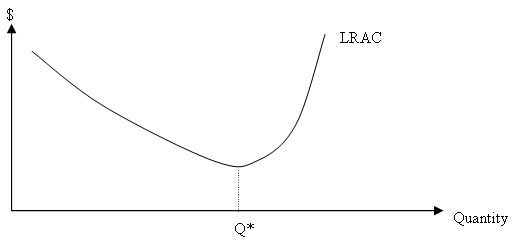

However, because budget carriers tend to be smaller than conventional national carriers, they may experience less economies of scale than their bigger rivals and thus incur higher average costs. But their success in European and American markets does seem to indicate that full service airlines have all along been overcharging consumers, and only now, feeling the heat of the competition, are they reducing prices which come from the exploitation of such economies. Yet on the other hand, bigger full service airlines may also experience diseconomies of scale and thus incur higher costs.

Overall though it does indeed seem that budget carriers' cost savings are much more than such diseconomies, thus they are able to offer lower prices in the end.

b) Comment on possible strategies the CEO of a budget carrier might adopt if it wishes to try to increase his firm's profits. [15]

Before analyzing the possible strategies, it is necessary to make qualifications with regard to the air travel market. For simplicity's sake, let this discussion regard only to economy class air travel. First and business class air travel may exist, but such price discrimination practices are not part of budget airline's strategy, so it is alright to leave that sector out for the moment and focus on the average traveller.

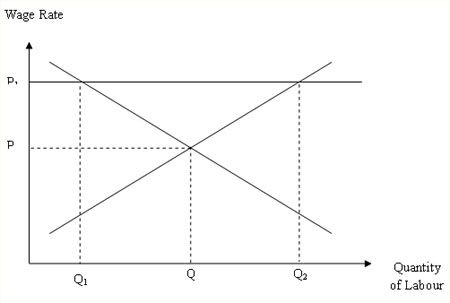

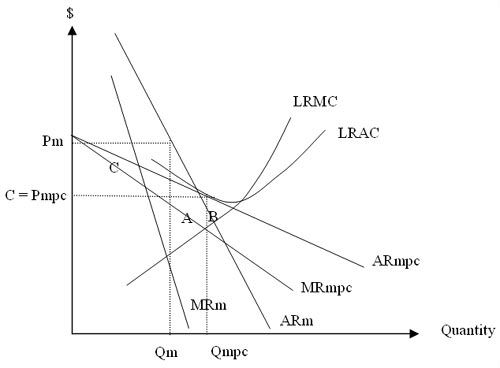

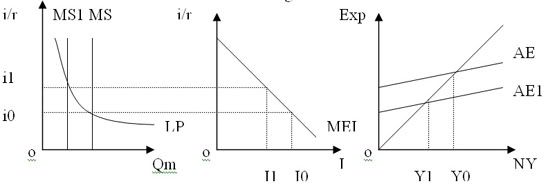

The market structure of the economy class airline industry can be said to be an oligopoly. Even though this analysis is only taking into account economy class tickets, the product may not be homogeneous. There are also only a few players with regard to a particular route and there are considerable barriers to entry (eg. buying an airplane is out of reach for most entrepreneurs). Thus, the market will adhere to the kinked demand theory as shown below.

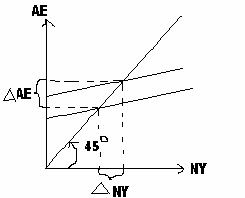

The demand curve is kinked in such a way if the firms in question are competitive, which is a safe assumption in the given example. Ceteris paribus, consumer demand, revenue and other factors are held constant in the SR. Assuming profit maximization (at MC = MR) and rational behaviour by firms, the price and quantity of airline trips should stabilise at P0 and Q0 respectively (point E). This is because if a firm were to increase price above P0 (should its marginal cost (MC) curve shift up beyond point A), then it will sell less as other oligopolistic firms, being competitive, do not follow suit. Thus, demand above point E is price elastic. However, if the firm decreases its price below P0, all other firms would follow it in an all out price war. Thus, demand below E is price inelastic since for the individual firm, a price cut will just mean all competitors follow suit, and the increase in quantity demanded will be shared across all airlines.

In general, if firms profit maximise at MC equal to marginal revenue (MR), then for any MC curve cutting the MR in between points A and B on the MR, the price and quantity produced will be at P0 and Q0 respectively.

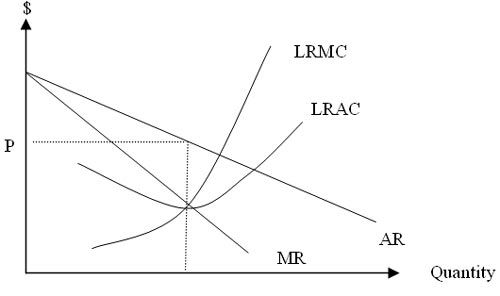

In order to increase profits, it is therefore necessary to shift the average cost (AC) and MC curves down in the form of price competition. This is shown in the diagram. Originally, with AC1 and MC1, the firm's profit is the shaded grey region. If AC1 and MC1 shift down to AC2 and MC2, profit increases by the shaded green region. Total profit increases to P0EDC2.

To lower the AC curve, there are many measures an airline can take. It can cut down on services provided during flights as what the budget carriers have done. It can dock at secondary airports or not dock at the terminals to decrease landing fees. Other cost cutting measures include increasing labour productivity, cutting wages of aircrew, not providing certain services (such as food and onboard entertainment) to flyers, and finding more fuel efficient ways to fly. Such measures would decrease average costs overall by cutting back waste. This will in turn increase profits by shifting down the AC curve as shown in the diagram.

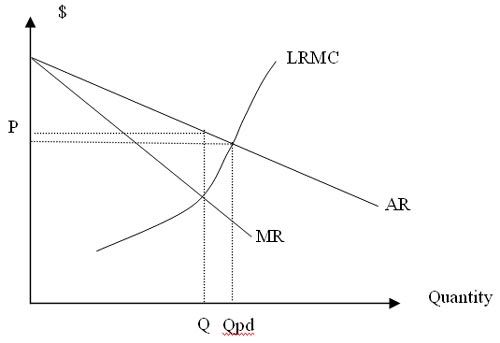

However, once the MC reaches point B, it is up to the firm to decide whether to instigate a price war. If it does, so, the kink on the demand curve will shift down and this may actually cause a fall in profits, should AR fall below AC. Within this concept of game theory, it also needs to consider whether it will be able to cope in the long run or fizzle out and become bankrupt. Hence, the uncertainty of the market structure may cause firms to in fact not want to maximize profits at MC = MR due to the unanticipated responses of other oligopolies.

In the shorter run, firms may want to engage in non-price competition. Advertising can increase demand and price elasticity of its product. It may emphasize the differences of its airline against its rivals and differentiate its brand, thus increasing demand for its airline. It may also want to start a frequent flyers program to encourage loyalty of consumers and offer them discounts.

These are just some of the strategies that an airline can adopt. However, they may not be all that good. They should be applied with the competitors' responses in mind.

In reality, it is difficult to gauge the kink in the demand curve and firms are likely not to know which point of production actually maximises profit. Due to these uncertainties in the theory itself, it may not accurately reflect real world circumstances. Firms may also have alternative aims such as revenue or sales maximisation or multiple satisficing aims. Other problems such as principal-agent diversions must also be taken into account.