A recent Economist magazine reported that the United States' current account deficit is $2 billion a day.

a. Are current account deficits a serious economic problem? [10]

b. Evaluate the strategies that can be used to correct current account deficits. [15]

A current account refers to the income and expenditure of the country on current purchases of goods and services. It is made up of 2 components, the import and export of merchandise goods and import and export of invisibles, including unilateral transfers which refers to transfer of funds not due to exchange of goods and services such as overseas aid. The current account is the sum of visible trade balance (value of visible exports-value of visible imports) and invisible balance (value of invisible exports-value of invisible imports). Invisibles include services rendered to or received from foreigners and dividends paid to or received from foreigners for investment here or overseas.

A temporary current account deficit may not be a big problem. If it is due to the import of capital equipment or foreign expertise in order to promote economic growth, the deficit now can result in a future stream of income into the country and is good.

However, if current account deficits are persistent, then they are bad for the country. Firstly, this may lead to a depletion of foreign reserves which are used to buy imports. This reduces the country’s ability to buy imports in the future. The country also has to borrow to cover up the deficit and will face the increased burden of having to pay them back. It also lowers the confidence of investors in the country. This is because the domestic currency may devalue without enough reserves to set it at the same price so investments in the country denominated in domestic currency will fall in price. This discourages local and foreign investors which will lower the level of investments, leading to capital flight and a decrease in aggregate expenditure (AE) which is the planned spending on all output and results in a downward shift of AE leading to a recession due to the multiplier effect which reduces national income and employment.

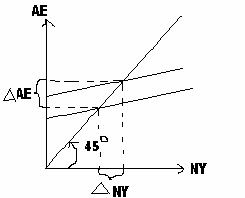

From the graph, the decrease in AE leads to a greater than proportionate decrease in national income, leading to lower welfare for the people. Stocks and shares can also crash, leading to destruction of wealth and bankruptcy. However all these problems will not exist if the capital account surplus out the current account deficit and there will not be an outflow of foreign currencies in this case. We need to examine the reason for the current account deficit. If it is due to lower exports as a result of higher price thus uncompetitive and increased imports as they are cheaper, this reduces (exports-imports) , a component of AE, which causes the multiplier effect.

There are some strategies to correct current account deficits.

In the short term, the country can run down its gold and foreign reserves to cover it, or to borrow from the International Monetary Fund and other Central Banks. In the long run, the government can also encourage exports by giving grants , loans or tax incentives to producers to lower their cost of production, resulting in a larger output at a lower price. It can also assist in research and development work to find new and more efficient production methods. All these will make exports more competitive and probably increase the demand for exports. This works only if exports are price elastic, in which case the decrease in price leads to a greater than proportionate increase in quantity demanded and increase foreign earnings.

In the short run, the government can also use expenditure switching or expenditure reducing policies. In government reducing policies, the government can employ contractionary monetary or fiscal policies by reducing government expenditure, increase taxes or reduce the money supply to raise interest rate, lowering the level of AE leading to lower income and price. This reduces the demand for imports. This is used when inflation causes the deficit. The exports will also look cheaper in terms of foreign currency so demand for exports rise. Locals will also switch consumption to local goods.

However this will only work if the price elasticity of demand and supply of exports and imports are elastic. It can also result in lower income and higher unemployment. There may also be retaliation by trading partners leading to lower volume of exports. The wages may not be lowered if there is strong resistance from trade unions.

In government switching policies, the government can install trade barriers such as tariffs and quota to make imports less attractive by increasing their price so demand for them drops. However this will not work if the foreign producer’s goods are price inelastic or if he chooses to absorb most of the tax, resulting in little change in import volume. There may also be retaliation by trading partners. It also results in a misallocation of resources which destroys the benefits of trade. Consumers are also denied cheaper imports. Domestic producers may also become complacent and inefficient.

The government may also do devaluation, which is a public announcement to decrease the exchange rate of the currency, if it believes that the currency is overvalued. It hopes that this will increase demand for exports as they are cheaper in terms of foreign currencies and thus more competitive. It can also reduce the demand of imports due to the increased price in terms of domestic currency, switching consumption to local substitutes. However this will work only if the Marshall-Lerner Condition is matched The sum of price elasticity of demand of exports and imports must exceed 1 so it results in a fall in import expenditure and a rise in export earnings. In the short run, the price elasticities of demand for both are likely to be inelastic as contracts have been made long ago. Thus current account deficits will occur in the short run. The price elasticity of supply of exports and imports must also be elastic so that domestic supply of exports can increase in response to increased demand by allocating resources to it to prevent price from increasing which will occur if the supply of exports is inelastic, which increases price thus forgoing the benefits of devaluation. Supply of imports must also be elastic or they will not be able to decrease supply which remains high, so prices remain low, devaluation will not help then.

There must also be no imported inflation, which can result if the country is heavily dependent on imported foodstuff and raw materials. The increase in import price can thus lead to a general increase in units and prices. There may be a wage spiral as cost of living increases. There must also be no devaluation by trading partners which will result in competitive devaluation. There must also be no loss of confidence in the economy since the value of assets denominated in local currency falls. If foreign investors lose hope, they will take their capital out of the country. If they expected a further devaluation, this can lead to a great outflow of short term and long term capital, leading to capital flight. This will put more pressure on the currency and cause the balance of payment of the country to worsen. Thus the different strategies to correct current account deficits works only sometimes. They may also affect other components of the balance of payments adversely so it depends on the situation if we want to see whether they are worthwhile.

b. Evaluate the strategies that can be used to correct current account deficits. [15]

A current account refers to the income and expenditure of the country on current purchases of goods and services. It is made up of 2 components, the import and export of merchandise goods and import and export of invisibles, including unilateral transfers which refers to transfer of funds not due to exchange of goods and services such as overseas aid. The current account is the sum of visible trade balance (value of visible exports-value of visible imports) and invisible balance (value of invisible exports-value of invisible imports). Invisibles include services rendered to or received from foreigners and dividends paid to or received from foreigners for investment here or overseas.

A temporary current account deficit may not be a big problem. If it is due to the import of capital equipment or foreign expertise in order to promote economic growth, the deficit now can result in a future stream of income into the country and is good.

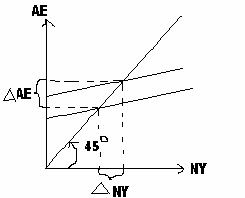

However, if current account deficits are persistent, then they are bad for the country. Firstly, this may lead to a depletion of foreign reserves which are used to buy imports. This reduces the country’s ability to buy imports in the future. The country also has to borrow to cover up the deficit and will face the increased burden of having to pay them back. It also lowers the confidence of investors in the country. This is because the domestic currency may devalue without enough reserves to set it at the same price so investments in the country denominated in domestic currency will fall in price. This discourages local and foreign investors which will lower the level of investments, leading to capital flight and a decrease in aggregate expenditure (AE) which is the planned spending on all output and results in a downward shift of AE leading to a recession due to the multiplier effect which reduces national income and employment.

From the graph, the decrease in AE leads to a greater than proportionate decrease in national income, leading to lower welfare for the people. Stocks and shares can also crash, leading to destruction of wealth and bankruptcy. However all these problems will not exist if the capital account surplus out the current account deficit and there will not be an outflow of foreign currencies in this case. We need to examine the reason for the current account deficit. If it is due to lower exports as a result of higher price thus uncompetitive and increased imports as they are cheaper, this reduces (exports-imports) , a component of AE, which causes the multiplier effect.

There are some strategies to correct current account deficits.

In the short term, the country can run down its gold and foreign reserves to cover it, or to borrow from the International Monetary Fund and other Central Banks. In the long run, the government can also encourage exports by giving grants , loans or tax incentives to producers to lower their cost of production, resulting in a larger output at a lower price. It can also assist in research and development work to find new and more efficient production methods. All these will make exports more competitive and probably increase the demand for exports. This works only if exports are price elastic, in which case the decrease in price leads to a greater than proportionate increase in quantity demanded and increase foreign earnings.

In the short run, the government can also use expenditure switching or expenditure reducing policies. In government reducing policies, the government can employ contractionary monetary or fiscal policies by reducing government expenditure, increase taxes or reduce the money supply to raise interest rate, lowering the level of AE leading to lower income and price. This reduces the demand for imports. This is used when inflation causes the deficit. The exports will also look cheaper in terms of foreign currency so demand for exports rise. Locals will also switch consumption to local goods.

However this will only work if the price elasticity of demand and supply of exports and imports are elastic. It can also result in lower income and higher unemployment. There may also be retaliation by trading partners leading to lower volume of exports. The wages may not be lowered if there is strong resistance from trade unions.

In government switching policies, the government can install trade barriers such as tariffs and quota to make imports less attractive by increasing their price so demand for them drops. However this will not work if the foreign producer’s goods are price inelastic or if he chooses to absorb most of the tax, resulting in little change in import volume. There may also be retaliation by trading partners. It also results in a misallocation of resources which destroys the benefits of trade. Consumers are also denied cheaper imports. Domestic producers may also become complacent and inefficient.

The government may also do devaluation, which is a public announcement to decrease the exchange rate of the currency, if it believes that the currency is overvalued. It hopes that this will increase demand for exports as they are cheaper in terms of foreign currencies and thus more competitive. It can also reduce the demand of imports due to the increased price in terms of domestic currency, switching consumption to local substitutes. However this will work only if the Marshall-Lerner Condition is matched The sum of price elasticity of demand of exports and imports must exceed 1 so it results in a fall in import expenditure and a rise in export earnings. In the short run, the price elasticities of demand for both are likely to be inelastic as contracts have been made long ago. Thus current account deficits will occur in the short run. The price elasticity of supply of exports and imports must also be elastic so that domestic supply of exports can increase in response to increased demand by allocating resources to it to prevent price from increasing which will occur if the supply of exports is inelastic, which increases price thus forgoing the benefits of devaluation. Supply of imports must also be elastic or they will not be able to decrease supply which remains high, so prices remain low, devaluation will not help then.

There must also be no imported inflation, which can result if the country is heavily dependent on imported foodstuff and raw materials. The increase in import price can thus lead to a general increase in units and prices. There may be a wage spiral as cost of living increases. There must also be no devaluation by trading partners which will result in competitive devaluation. There must also be no loss of confidence in the economy since the value of assets denominated in local currency falls. If foreign investors lose hope, they will take their capital out of the country. If they expected a further devaluation, this can lead to a great outflow of short term and long term capital, leading to capital flight. This will put more pressure on the currency and cause the balance of payment of the country to worsen. Thus the different strategies to correct current account deficits works only sometimes. They may also affect other components of the balance of payments adversely so it depends on the situation if we want to see whether they are worthwhile.

1 Comments:

abercrombie and fitch, lunette oakley pas cher, jordan pas cher, michael kors, lunette ray ban pas cher, polo ralph lauren uk, sac guess pas cher, hollister uk, converse, replica handbags, nike blazer pas cher, michael kors, true religion outlet, nike free pas cher, coach outlet, north face uk, hermes pas cher, nike roshe uk, nike tn pas cher, burberry pas cher, north face pas cher, true religion jeans, lululemon outlet, nike air max uk, ray ban uk, true religion outlet, coach outlet store online, nike free, louboutin pas cher, nike air max, michael kors uk, vans pas cher, mulberry uk, longchamp soldes, nike air max uk, nike roshe run pas cher, timberland pas cher, nike air force, coach purses, hogan sito ufficiale, new balance, vanessa bruno pas cher, ralph lauren pas cher, kate spade outlet, abercrombie and fitch UK, michael kors outlet online, true religion outlet, polo lacoste pas cher

Post a Comment

Subscribe to Post Comments [Atom]

<< Home